30+ taking over mortgage payments

Unlock Your Home Equity Today in Exchange for a Percentage of Your Homes Future Value. Loans Up To 4 Million Loan-To-Values Up To 75 And Flexible Terms From 2-7 Years.

Online Mortgage Broker Finspo

For example your deceased parent may have left you a mortgaged home.

. Web There is a way to allow someone else to take over responsibility for a mortgage. Web Send your letter and copies of any documents that support your request to the mortgage servicers customer service address by certified mail and request a return. Web Refinancing a mortgage is also an option if the current payment is out of reach.

All you need to do is make a down payment of 5000 and the property is. Web To take over the mortgage on an inherited house youll first need to talk to the servicer of the loan and let them know that youve inherited the property. If you have an escrow account you.

Interest rates may have changed in your favor since the original mortgagor took out the loan as well. Your monthly payment is 107771. Ad No monthly payments.

Ad 5 Best House Loan Lenders Compared Reviewed. The servicer will let you know what they need from you. Looking For a House Loan.

Over the last several years FHAs mortgage insurance fund has accumulated. Youll likely need to provide proof of the persons passing as well as documents showing that you are the rightful heir to the home. Sometimes this can make the monthly payment more affordable.

Web Stretching the mortgage to 30 years makes the monthly payment more affordable but youll be paying off your loan for much longer and youll wind up paying a. In real estate these loans are known as assumable loans. Requirements to assume a loan vary among lenders.

Web For most borrowers the total monthly payment sent to your mortgage lender includes other costs such as homeowners insurance and taxes. Account for interest rates and break down payments in an easy to use amortization schedule. Web This means the buyer takes over making payments on the mortgage without involving the lender.

Web A family buying a home in Austin with a 500000 mortgage will save 1500 per year. Even though you are taking over the loan the. Contact the current lender to request assumption information.

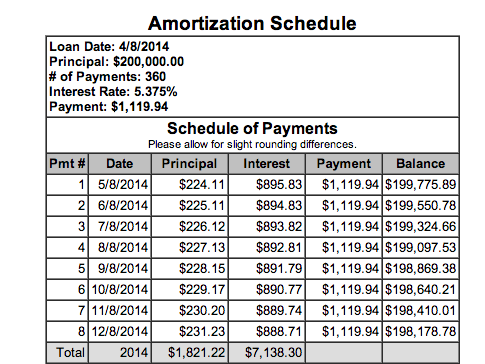

Web If you buy a home with a loan for 200000 at 433 percent your monthly payment on a 30-year loan would be 99327 and you would pay 15757691 in interest. Web The propertys take over mortgage is valued at 95000 with a 7 percent interest rate. Find A Lender That Offers Great Service.

Web Whether a traditional 30-year mortgage is right for you depends on your financial situation. When a mortgaged. Web A 1982 federal law makes it easy for relatives inheriting a mortgaged home to assume its mortgage as well.

When you take over a mortgage you can extend the term of the loan through a refinanced loan. Ad Choose the Right Amount to Borrow by Calculating Your Monthly Loan Payment. Anyone can do a simple assumption through a purely private.

Ad Mortgage Rates Are Constantly Changing. Get Preapproved By a Lender You Could Save. Compare Lenders And Find Out Which One Suits You Best.

Pros of a 30-year Mortgage Lower monthly payments since the loan is spread out over 30. Ad Val-Chris Is A Private Money Lender Specializing In Both Residential And Commercial Loans. Compare More Than Just Rates.

Web On a 30-year mortgage with a 700 fixed interest rate youll pay 41852669 in interest over the life of your loan. Web Use our free mortgage calculator to estimate your monthly mortgage payments. Web For example lets assume you take an initial mortgage of 240000 on a 300000 purchase with a 20 down payment.

Thats about two-thirds of what you. Comparisons Trusted by 55000000. Its not a loan its a home equity agreement.

Reading Between The Student Loan Headlines How To Engage Consumers With Multiple Debts Trueaccord Blog

Are There Credit Consequences Of Mortgage Forbearance Find My Way Home

Should You Pay Off Your Mortgage Or Invest The Cash

Pay Off Your 30 Year Home Loan 6 Years Faster 10 Easy Tips Easy

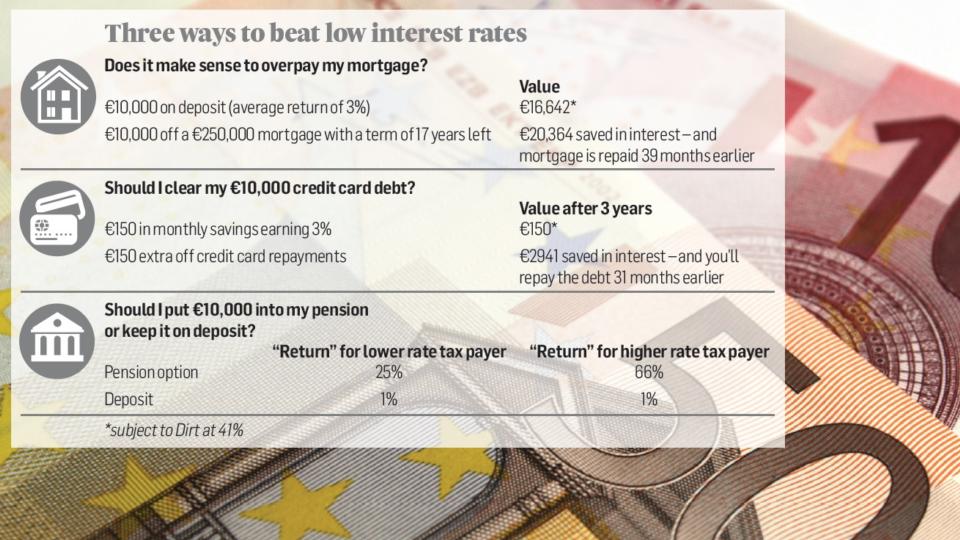

Forget Deposits Knock 10 000 Off Your Mortgage And Reap Much Greater Rewards The Irish Times

Untitled Document

Mortgage Delinquencies Rose For The First Time In 9 Months What Does That Mean Marketwatch

What Happens If I Pay An Extra 30 A Month On My Mortgage

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

How To Remove 30 Day Late Payments From Reports 2023 Guide

.png)

Savills Gibraltar Article

Ask An Ex Banker Mortgages Part Ii Should I Pay My Mortgage Early Bankers Anonymous

:max_bytes(150000):strip_icc()/student-loan-forgiveness-2000-f89acb0efe8e45eba2e101e39870757e.jpg)

Are Those Student Loan Forgiveness Calls Real

Create A Loan Amortization Schedule In Excel With Extra Payments

Why Homeowners In Their 30s Shouldn T Worry About Paying Off The Mortgage Gobankingrates

Desperation To Get On The Property Ladder Pushes Buyers To 30 Year Loans

Mortgage Due Dates 101 Is There Really A Grace Period