Prior depreciation calculator

Depreciation calculators online for primary methods of depreciation including the ability to create depreciation schedules. Click this icon to open the Prior Depreciation Comparison.

Macrs Depreciation Calculator Straight Line Double Declining

You would have to calculate the depreciation figures.

. The calculator also estimates the first year and the total vehicle depreciation. Where Di is the depreciation in year i. If no depreciation was deducted the adjustment is the total depreciation allowable prior to the year of change.

Also includes a specialized real estate property calculator. Select the currency from the drop-down list optional Enter the. In the Prior Depreciation Comparison panel you can change the.

It provides a couple different methods of depreciation. 1 Best answer. In the simplest terms depreciation is the decrease in valueImagine that you bought a car for 20000.

Click in the Prior Depreciation field to reveal a calculator icon. After a few years the vehicle is not what it used to be in the. If this is the first year you have offered the property as a rental and have never taken depreciation in a prior tax year the value of Prior.

All you need to do is. This MACRS Depreciation Calculator supports nearly all the nuances and conventions of the Internal Revenue Code. June 4 2019 641 PM.

It includes support for qualified and listed assets including motor. Click this icon to open the Prior Depreciation Comparison. First one can choose the straight line method of.

C is the original purchase price or basis of an asset. It is fairly simple to use. Click in the Prior Depreciation field to reveal a calculator icon.

A negative section 481a adjustment results in a decrease in taxable income. D i C R i. In the Prior Depreciation Comparison panel you can change the.

This depreciation calculator is for calculating the depreciation schedule of an asset. Since you used the mileage allowance in previous years you would multiply your business miles in 2020 by 027. The MACRS Depreciation Calculator uses the following basic formula.

In the Prior Depreciation Comparison dialog click the tab for the desired treatment and compare the amounts displayed in the Amount on file and the Computed amount fields.

How To Use The Excel Db Function Exceljet

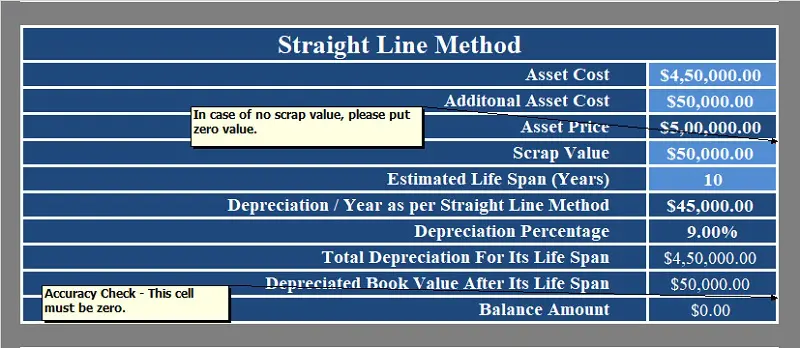

Download Depreciation Calculator Excel Template Exceldatapro

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Macrs Depreciation Calculator Straight Line Double Declining

Macrs Depreciation Calculator Irs Publication 946

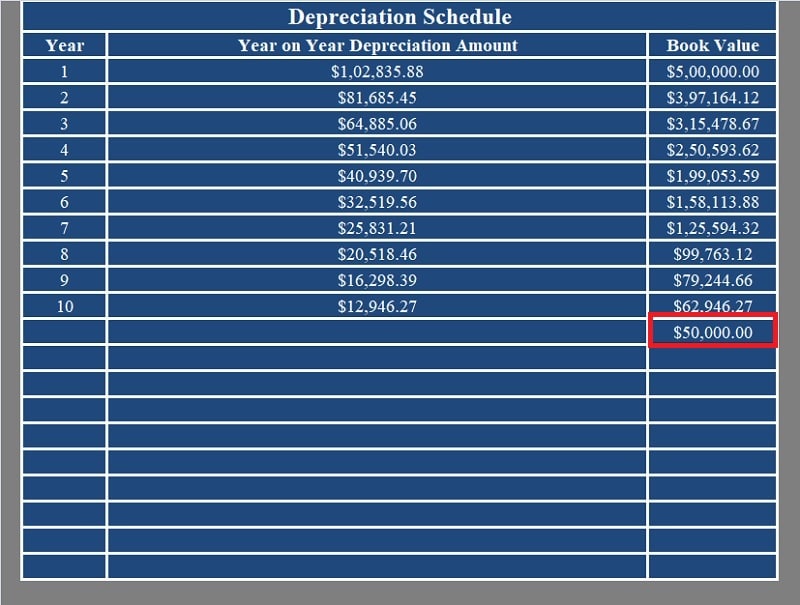

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Methods Principlesofaccounting Com

Free Macrs Depreciation Calculator For Excel

Declining Balance Method Of Depreciation Formula Depreciation Guru

Macrs Depreciation Calculator Irs Publication 946

Depreciation Calculator Definition Formula

Macrs Depreciation Calculator Based On Irs Publication 946

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Template For Straight Line And Declining Balance